European SME Deal Origination for M&A

Add up to 20+ qualified owner conversations to your calendar each month.

Add up to 20+ qualified owner conversations to your calendar each month.

Add up to 20+ qualified owner conversations to your calendar each month.

We do the target screening, trace ownership, and initiate discreet conversations in the local language. You get connected when decision makers signal interest. We handle the complexity.

27 MARKETS · 24 LANGUAGES · GDPR-COMPLIANT

We don't just find companies - we open doors. Discreet outreach that protects your identity until the moment is right.

Oliver Sonntag, Founder

WHAT WE SOLVE

European Sourcing Doesn't Work Like US Sourcing

Fragmented Data | Hidden Ownership | Language Barriers | Cultural Mismatch | Compliance Risk

DACH Expansion

Hidden Champion Discovery

Succession Signal Detection

European Target Sourcing

Fragmented Data

There's no European PitchBook for SMEs. Owner information is scattered across 27 national registries, each with different access rules and data quality. We've solved this - so you don't have to.

DACH Expansion

Hidden Champion Discovery

Succession Signal Detection

European Target Sourcing

Fragmented Data

There's no European PitchBook for SMEs. Owner information is scattered across 27 national registries, each with different access rules and data quality. We've solved this - so you don't have to.

DACH Expansion

Hidden Champion Discovery

Succession Signal Detection

European Target Sourcing

Fragmented Data

There's no European PitchBook for SMEs. Owner information is scattered across 27 national registries, each with different access rules and data quality. We've solved this - so you don't have to.

Hidden Ownership

The managing director on the website often isn't the decision-maker. The real owner sits behind a Dutch holding, a German GmbH & Co. KG, or a family foundation. We trace beneficial ownership through holding structures.

Hidden Ownership

The managing director on the website often isn't the decision-maker. The real owner sits behind a Dutch holding, a German GmbH & Co. KG, or a family foundation. We trace beneficial ownership through holding structures.

Hidden Ownership

The managing director on the website often isn't the decision-maker. The real owner sits behind a Dutch holding, a German GmbH & Co. KG, or a family foundation. We trace beneficial ownership through holding structures.

Fragmented Market

Solve

Regulatory Requirements

Language Barriers

Cultural Mismatch

Language Barriers

Your English email to a Mittelstand owner in Bavaria? Deleted. Your perfectly translated German email with American directness? Also deleted. We write in native languages—not translated, written.

Fragmented Market

Solve

Regulatory Requirements

Language Barriers

Cultural Mismatch

Language Barriers

Your English email to a Mittelstand owner in Bavaria? Deleted. Your perfectly translated German email with American directness? Also deleted. We write in native languages—not translated, written.

Fragmented Market

Solve

Regulatory Requirements

Language Barriers

Cultural Mismatch

Language Barriers

Your English email to a Mittelstand owner in Bavaria? Deleted. Your perfectly translated German email with American directness? Also deleted. We write in native languages—not translated, written.

Code

1

2

3

4

5

Cultural Mismatch

European founders - especially in DACH - don't respond to "exciting acquisition opportunities." They respond to discretion, respect, and patience. Generic Cold outreach fails. Highly culturally optimized one will open doors.

Code

1

2

3

4

5

Cultural Mismatch

European founders - especially in DACH - don't respond to "exciting acquisition opportunities." They respond to discretion, respect, and patience. Generic Cold outreach fails. Highly culturally optimized one will open doors.

Code

1

2

3

4

5

Cultural Mismatch

European founders - especially in DACH - don't respond to "exciting acquisition opportunities." They respond to discretion, respect, and patience. Generic Cold outreach fails. Highly culturally optimized one will open doors.

BENEFITS

Why Investors Choose Our Approach

Why Investors Choose Our Approach

Access off-market conversations. Protect your identity initially. Keep 100% of your transaction.

Discreet Outreach That Protects Your Identity

European owners don't respond well to direct investor approaches. We initiate conversations on your behalf - without revealing your identity. You only get connected after an owner signals genuine interest. Your reputation stays protected.

Discreet Outreach That Protects Your Identity

European owners don't respond well to direct investor approaches. We initiate conversations on your behalf - without revealing your identity. You only get connected after an owner signals genuine interest. Your reputation stays protected.

Discreet Outreach That Protects Your Identity

European owners don't respond well to direct investor approaches. We initiate conversations on your behalf - without revealing your identity. You only get connected after an owner signals genuine interest. Your reputation stays protected.

Qualified Interest, Not Cold Introductions

We don't hand you a list of names. We deliver owners who have already expressed openness to a conversation. When we connect you, the door is already open.

Qualified Interest, Not Cold Introductions

We don't hand you a list of names. We deliver owners who have already expressed openness to a conversation. When we connect you, the door is already open.

Qualified Interest, Not Cold Introductions

We don't hand you a list of names. We deliver owners who have already expressed openness to a conversation. When we connect you, the door is already open.

Flat Monthly Fees. No Success Fees. Aligned Incentives.

Unlike traditional M&A advisors charging 1-3% of transaction value, our fee model is based on work delivered: target identification, discreet outreach, and qualified introductions. You keep 100% of your deal economics.

Flat Monthly Fees. No Success Fees. Aligned Incentives.

Unlike traditional M&A advisors charging 1-3% of transaction value, our fee model is based on work delivered: target identification, discreet outreach, and qualified introductions. You keep 100% of your deal economics.

Flat Monthly Fees. No Success Fees. Aligned Incentives.

Unlike traditional M&A advisors charging 1-3% of transaction value, our fee model is based on work delivered: target identification, discreet outreach, and qualified introductions. You keep 100% of your deal economics.

FEATURES

Managed Deal Origination Capabilities

What deal databases can't show you. What local advisors charge €100K to find.

Target Identification

Complete target lists built from public sources and 27+ national registries (Handelsregister, Companies House, KvK, Bolagsverket, and more). If possible: Beneficial owner identification through UBO registers and proprietary tracing or Competitive flags (PE-backed, recently approached, active sale process).

Target Identification

Complete target lists built from public sources and 27+ national registries (Handelsregister, Companies House, KvK, Bolagsverket, and more). If possible: Beneficial owner identification through UBO registers and proprietary tracing or Competitive flags (PE-backed, recently approached, active sale process).

Target Identification

Complete target lists built from public sources and 27+ national registries (Handelsregister, Companies House, KvK, Bolagsverket, and more). If possible: Beneficial owner identification through UBO registers and proprietary tracing or Competitive flags (PE-backed, recently approached, active sale process).

Discreet Native-Language Outreach

We approach owners in their language, with culturally appropriate messaging. No investor branding. No pressure. Professional, relationship-first conversations that respect European business culture.

Discreet Native-Language Outreach

We approach owners in their language, with culturally appropriate messaging. No investor branding. No pressure. Professional, relationship-first conversations that respect European business culture.

Discreet Native-Language Outreach

We approach owners in their language, with culturally appropriate messaging. No investor branding. No pressure. Professional, relationship-first conversations that respect European business culture.

Multi-Language Intelligence

Native-level: German, French, Dutch, Swedish, Spanish, English. Professional-level: Italian, Polish, Danish, Norwegian. European intelligence requires European languages.

Multi-Language Intelligence

Native-level: German, French, Dutch, Swedish, Spanish, English. Professional-level: Italian, Polish, Danish, Norwegian. European intelligence requires European languages.

Multi-Language Intelligence

Native-level: German, French, Dutch, Swedish, Spanish, English. Professional-level: Italian, Polish, Danish, Norwegian. European intelligence requires European languages.

Interest-Based Introductions

You receive introductions only when owners signal genuine interest. No wasted calls with uninterested parties. Every conversation starts from a position of mutual openness.

Interest-Based Introductions

You receive introductions only when owners signal genuine interest. No wasted calls with uninterested parties. Every conversation starts from a position of mutual openness.

Interest-Based Introductions

You receive introductions only when owners signal genuine interest. No wasted calls with uninterested parties. Every conversation starts from a position of mutual openness.

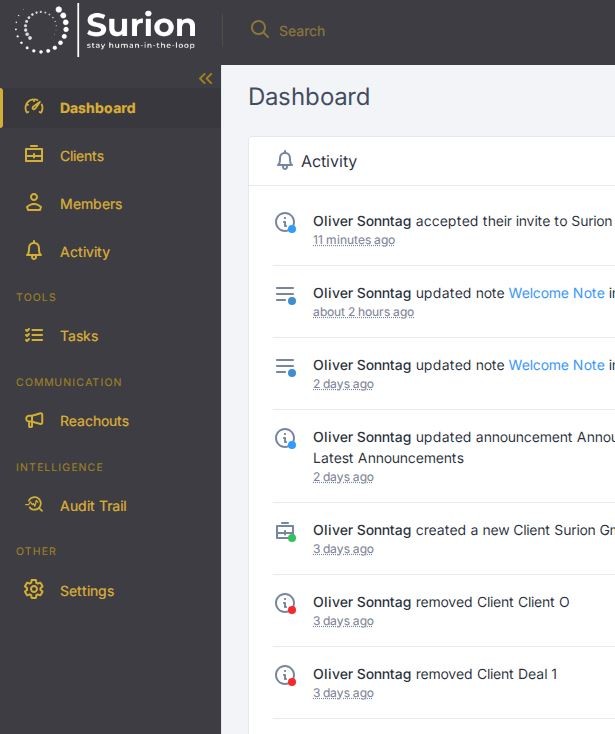

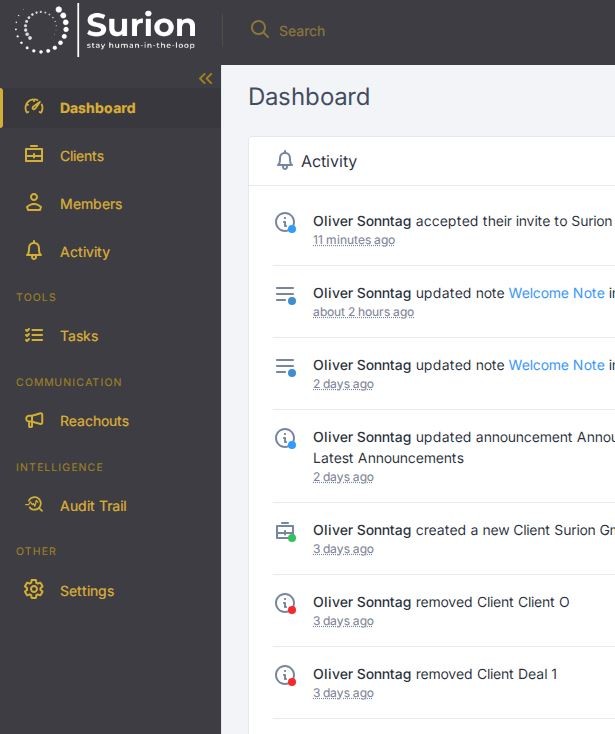

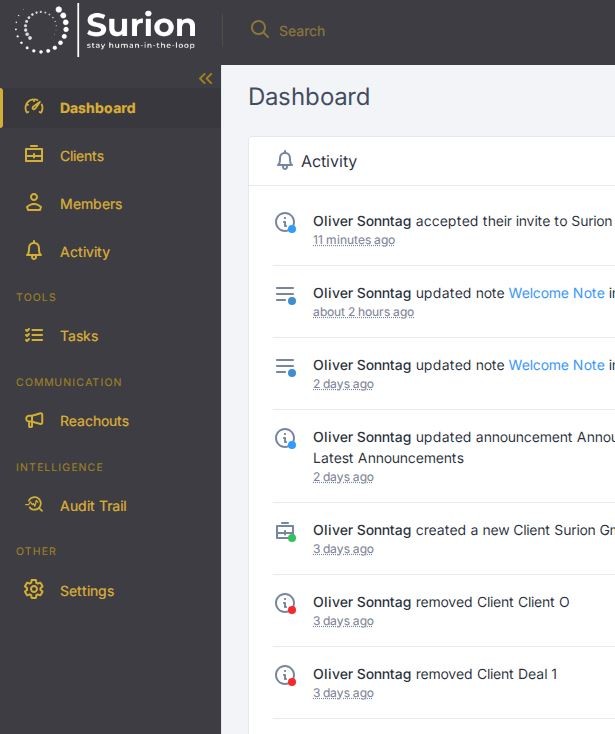

Real-Time Pipeline Visibility

Portal access showing campaign progress, response rates, and qualified opportunities. CRM integration optional. Monthly strategy calls.

Real-Time Pipeline Visibility

Portal access showing campaign progress, response rates, and qualified opportunities. CRM integration optional. Monthly strategy calls.

Real-Time Pipeline Visibility

Portal access showing campaign progress, response rates, and qualified opportunities. CRM integration optional. Monthly strategy calls.

PROCESS

How We Build Your European Pipeline

How We Build Your European Pipeline

Week by Week

STEP 1

STEP 2

STEP 3

01

Thesis Alignment (Day 1)

We learn your investment criteria and translate them for European markets. How do your size, sector, and geographic preferences map to European company structures? Which markets have sufficient target density? What messaging approach fits your thesis? Output: European targeting brief + geographic prioritisation.

STEP 1

STEP 2

STEP 3

01

Thesis Alignment (Day 1)

We learn your investment criteria and translate them for European markets. How do your size, sector, and geographic preferences map to European company structures? Which markets have sufficient target density? What messaging approach fits your thesis? Output: European targeting brief + geographic prioritisation.

STEP 1

STEP 2

STEP 3

01

Thesis Alignment (Day 1)

We learn your investment criteria and translate them for European markets. How do your size, sector, and geographic preferences map to European company structures? Which markets have sufficient target density? What messaging approach fits your thesis? Output: European targeting brief + geographic prioritisation.

PLATFORM

Virtual Data Room

A secure, centralized location for the storage and sharing of sensitive business information. GDPR conform, build on an ISO 27001 certified platform with clinked.

COMPARE US

Re-Inventing European Deal Sourcing

Off-Market Deal Origination

The Platform Advantage

Systematic Deal Origination at Scale - Integrated CRM tracking every target from first contact to handover - Automated sequencing with personalized, native-language outreach - Real-time pipeline visibility through your dedicated portal - Qualification workflows that surface genuine seller interest - Structured handover process when meaningful traction exists - Continuous nurture of leads until timing aligns

%

European Depth

%

Pipeline Visability

The Pipeline Engine

From Target Mapping to Qualified Introduction - Criteria-based identification across European registries - Decision maker mapping with verified contact data - Sequenced outreach adapted to European business culture - Interest qualification with standardized notes and next steps - Warm introductions only after genuine engagement confirmed - Re-engagement campaigns for leads with future potential

%

European-Native

%

Success Fee

The Secure Deal Room

Where Discretion Meets Efficiency - Permissioned access controls for every document and conversation - Secure channels replacing scattered email threads - Staged information release as relationships progress - Audit trails and activity tracking for compliance - Seamless NDA workflow and document exchange - Single source of truth for all deal materials

%

Encrypted Exchange

%

Data Leaks

The Platform Advantage

Systematic Deal Origination at Scale - Integrated CRM tracking every target from first contact to handover - Automated sequencing with personalized, native-language outreach - Real-time pipeline visibility through your dedicated portal - Qualification workflows that surface genuine seller interest - Structured handover process when meaningful traction exists - Continuous nurture of leads until timing aligns

%

European Depth

%

Pipeline Visability

The Pipeline Engine

From Target Mapping to Qualified Introduction - Criteria-based identification across European registries - Decision maker mapping with verified contact data - Sequenced outreach adapted to European business culture - Interest qualification with standardized notes and next steps - Warm introductions only after genuine engagement confirmed - Re-engagement campaigns for leads with future potential

%

European-Native

%

Success Fee

The Secure Deal Room

Where Discretion Meets Efficiency - Permissioned access controls for every document and conversation - Secure channels replacing scattered email threads - Staged information release as relationships progress - Audit trails and activity tracking for compliance - Seamless NDA workflow and document exchange - Single source of truth for all deal materials

%

Encrypted Exchange

%

Data Leaks

The Platform Advantage

Systematic Deal Origination at Scale - Integrated CRM tracking every target from first contact to handover - Automated sequencing with personalized, native-language outreach - Real-time pipeline visibility through your dedicated portal - Qualification workflows that surface genuine seller interest - Structured handover process when meaningful traction exists - Continuous nurture of leads until timing aligns

%

European Depth

%

Pipeline Visability

The Pipeline Engine

From Target Mapping to Qualified Introduction - Criteria-based identification across European registries - Decision maker mapping with verified contact data - Sequenced outreach adapted to European business culture - Interest qualification with standardized notes and next steps - Warm introductions only after genuine engagement confirmed - Re-engagement campaigns for leads with future potential

%

European-Native

%

Success Fee

The Secure Deal Room

Where Discretion Meets Efficiency - Permissioned access controls for every document and conversation - Secure channels replacing scattered email threads - Staged information release as relationships progress - Audit trails and activity tracking for compliance - Seamless NDA workflow and document exchange - Single source of truth for all deal materials

%

Encrypted Exchange

%

Data Leaks

TECHNOLOGY

European Data Infrastructure

500K+ SMEs on Demand. 15+ public registers to reach.

WHO WE SERVE

For Private Equity, Corporate Development, and Family Offices

Discreet European deal flow. Qualified introductions.

Private Equity

For platform and add-on sourcing across European markets. You need off-market pipeline without paying 2% success fees on every closed deal. You need coverage in markets where you don't have boots on the ground—without broadcasting your interest.

Private Equity

For platform and add-on sourcing across European markets. You need off-market pipeline without paying 2% success fees on every closed deal. You need coverage in markets where you don't have boots on the ground—without broadcasting your interest.

Private Equity

For platform and add-on sourcing across European markets. You need off-market pipeline without paying 2% success fees on every closed deal. You need coverage in markets where you don't have boots on the ground—without broadcasting your interest.

Corporate Development

For European market entry without headcount expansion. Your BD team is focused on core markets. European expansion is strategic but building regional capacity is slow and expensive. Discreet outreach protects your strategic intentions.

Corporate Development

For European market entry without headcount expansion. Your BD team is focused on core markets. European expansion is strategic but building regional capacity is slow and expensive. Discreet outreach protects your strategic intentions.

Corporate Development

For European market entry without headcount expansion. Your BD team is focused on core markets. European expansion is strategic but building regional capacity is slow and expensive. Discreet outreach protects your strategic intentions.

Family Offices

For relationship-driven, discretion-first sourcing. Family office acquisitions require patience and trust - especially in Europe where seller motivations often centre on legacy, not exit multiples. We approach owners quietly and connect you only when there's genuine openness.

Family Offices

For relationship-driven, discretion-first sourcing. Family office acquisitions require patience and trust - especially in Europe where seller motivations often centre on legacy, not exit multiples. We approach owners quietly and connect you only when there's genuine openness.

Family Offices

For relationship-driven, discretion-first sourcing. Family office acquisitions require patience and trust - especially in Europe where seller motivations often centre on legacy, not exit multiples. We approach owners quietly and connect you only when there's genuine openness.

Search Funds & Independent Sponsors

For time-constrained thesis validation. Your search window is finite. Visa constraints, fund timelines, and LP patience all create pressure. Rapid market mapping and discreet outreach get you in front of interested owners in weeks, not months.

Search Funds & Independent Sponsors

For time-constrained thesis validation. Your search window is finite. Visa constraints, fund timelines, and LP patience all create pressure. Rapid market mapping and discreet outreach get you in front of interested owners in weeks, not months.

Search Funds & Independent Sponsors

For time-constrained thesis validation. Your search window is finite. Visa constraints, fund timelines, and LP patience all create pressure. Rapid market mapping and discreet outreach get you in front of interested owners in weeks, not months.

Outcome: Extended Geographic Reach

Cover 15 European markets without hiring local teams in each country.

Outcome: Extended Geographic Reach

Cover 15 European markets without hiring local teams in each country.

Outcome: Extended Geographic Reach

Cover 15 European markets without hiring local teams in each country.

Qualified Introductions

Meet only owners who have expressed genuine interest in a conversation.

Qualified Introductions

Meet only owners who have expressed genuine interest in a conversation.

Qualified Introductions

Meet only owners who have expressed genuine interest in a conversation.

PRICING

Flat Fees. No Success Fees. No Surprises.

Flat Fees. No Success Fees. No Surprises.

Choose the engagement model that fits your coverage needs. You pay for our work - not a percentage of your deals.

Choose the engagement model that fits your coverage needs. You pay for our work - not a percentage of your deals.

SEARCH PARTNERSHIP

€ 2,500/month + VAT, cancel anytime

All European markets. Market mapping

Target build + decision-maker mapping

Secure Virtual Data Room

Monthly strategy call

Typical outcome: 100-1000 qualified targets

Timeline: First target list within days; refreshed target drops every week

STANDARD ENGAGEMENT

€4,500/month, chancel anytime

For firms with an established European thesis seeking a consistent pipeline.

Full service across 1 market/language

Secure Virtual Data Room

Dedicated Analyst

Priority response times

Typical outcome: 4-20 + qualified introductions/month

Timeline: First approved target list within 5 days. Outreach live within 10 days.

ORIGINATION DESK

Popular

Custom pricing

For firms that want a predictable, pan-DACH / pan-European pipeline — run like an internal CorpDev + SDR team, without the headcount.

You get an always-on M&A origination pod that owns the full top-of-funnel: thesis → targets → outreach → reply handling → qualification → meeting booked → pipeline reporting.

Multi-market & multi-language coverage

Qualification layer (fit checks + key questions + concise opportunity brief before handoff)

Typical outcome: A consistent stream of qualified conversations and booked meetings across multiple markets — with full pipeline visibility and continuous optimisation.

Timeline: First approved target list within days. Outreach live within 10 days.

SEARCH PARTNERSHIP

€ 2,500/month + VAT, cancel anytime

All European markets. Market mapping

Target build + decision-maker mapping

Secure Virtual Data Room

Monthly strategy call

Typical outcome: 100-1000 qualified targets

Timeline: First target list within days; refreshed target drops every week

STANDARD ENGAGEMENT

€4,500/month, chancel anytime

For firms with an established European thesis seeking a consistent pipeline.

Full service across 1 market/language

Secure Virtual Data Room

Dedicated Analyst

Priority response times

Typical outcome: 4-20 + qualified introductions/month

Timeline: First approved target list within 5 days. Outreach live within 10 days.

ORIGINATION DESK

Popular

Custom pricing

For firms that want a predictable, pan-DACH / pan-European pipeline — run like an internal CorpDev + SDR team, without the headcount.

You get an always-on M&A origination pod that owns the full top-of-funnel: thesis → targets → outreach → reply handling → qualification → meeting booked → pipeline reporting.

Multi-market & multi-language coverage

Qualification layer (fit checks + key questions + concise opportunity brief before handoff)

Typical outcome: A consistent stream of qualified conversations and booked meetings across multiple markets — with full pipeline visibility and continuous optimisation.

Timeline: First approved target list within days. Outreach live within 10 days.

FAQs

Frequently Asked Questions

Find quick answers to common questions

Still Have Questions?

Feel free to get in touch with us today!

What results can I expect?

Standard Engagement: 200 - 500 decision makers approached monthly, 4–15 qualified introductions. Origination Desk: Typical outcome: A consistent stream of qualified conversations and booked meetings across multiple markets - with full pipeline visibility and continuous optimisation. We share detailed benchmarks during our initial call based on comparable engagements.

What's a "qualified introduction"?

How does the discreet approach work?

We approach owners without revealing your identity. Our outreach positions the conversation around their business and potential interest in strategic discussions - not as a pitch from a specific buyer. When a decision maker signals genuine interest, we brief you on the opportunity and facilitate an introduction.

How fast can we start?

First approved target list within days. Outreach live within 10 days.

Who owns the data and relationships?

You do. All target data, outreach history, and introductions belong to you. Export anytime.

How do you handle GDPR?

Our outreach relies on legitimate interest (Article 6(1)(f)) for B2B communications. We maintain processing records, honour opt-out requests within 48 hours, and never use purchased lists. Full compliance documentation available on request.

Which languages do you support?

We cover all 24 EU Languages

Which markets do you cover?

We cover all 27 EU markets

Do you work with competitors?

We maintain thesis separation. If your criteria significantly overlaps with an existing client in the same geography, we'll discuss before engaging. In practice, most theses are sufficiently differentiated.

FAQs

Frequently Asked Questions

Find quick answers to common questions

Still Have Questions?

Feel free to get in touch with us today!

What results can I expect?

Standard Engagement: 200 - 500 decision makers approached monthly, 4–15 qualified introductions. Origination Desk: Typical outcome: A consistent stream of qualified conversations and booked meetings across multiple markets - with full pipeline visibility and continuous optimisation. We share detailed benchmarks during our initial call based on comparable engagements.

What's a "qualified introduction"?

How does the discreet approach work?

We approach owners without revealing your identity. Our outreach positions the conversation around their business and potential interest in strategic discussions - not as a pitch from a specific buyer. When a decision maker signals genuine interest, we brief you on the opportunity and facilitate an introduction.

How fast can we start?

First approved target list within days. Outreach live within 10 days.

Who owns the data and relationships?

You do. All target data, outreach history, and introductions belong to you. Export anytime.

How do you handle GDPR?

Our outreach relies on legitimate interest (Article 6(1)(f)) for B2B communications. We maintain processing records, honour opt-out requests within 48 hours, and never use purchased lists. Full compliance documentation available on request.

Which languages do you support?

We cover all 24 EU Languages

Which markets do you cover?

We cover all 27 EU markets

Do you work with competitors?

We maintain thesis separation. If your criteria significantly overlaps with an existing client in the same geography, we'll discuss before engaging. In practice, most theses are sufficiently differentiated.

FAQs

Frequently Asked Questions

Find quick answers to common questions

Still Have Questions?

Feel free to get in touch with us today!

What results can I expect?

What's a "qualified introduction"?

How does the discreet approach work?

How fast can we start?

Who owns the data and relationships?

How do you handle GDPR?

Which languages do you support?

Which markets do you cover?

Do you work with competitors?

COMPARE US

Why Choose Surion Over Alternatives

Why Choose Surion Over Alternatives

See how managed European sourcing compares

See how managed European sourcing compares

Results in days / weeks - not months

27+ European countries

Discreet outreach—your identity protected

Native-language conversations in 24 languages

Introductions only after interest confirmed

Flat monthly fees—no success fees

Local M&A Advisors

3-6 month engagements

€50-100K per country

Network-dependent, not data-driven

Single-country expertise

Potential conflicts with sell-side mandates

Success fees (1–3% of deal value)

US-Based Providers

limited data sources

10-20% European SME coverage

English or machine-translated

Same data as every competitor

Self-service – you do the work

Our Team

Get to Know Us

Get to Know Us

Visit our profiles

Let's Talk

Ready to Discuss Your European Coverage?

A 30-minute call to understand your thesis, assess target density, and determine if we're a fit. No pitch deck. No pressure. Just a conversation about what you're trying to source and whether we can help.

info@surion-group.com

Let's Talk

Ready to Discuss Your European Coverage?

A 30-minute call to understand your thesis, assess target density, and determine if we're a fit. No pitch deck. No pressure. Just a conversation about what you're trying to source and whether we can help.

info@surion-group.com

Let's Talk

Ready to Discuss Your European Coverage?

A 30-minute call to understand your thesis, assess target density, and determine if we're a fit. No pitch deck. No pressure. Just a conversation about what you're trying to source and whether we can help.

info@surion-group.com